What Is Slippage Tolerance: Meaning, Which One Should You Use, And More

✍️ 22 December, 2023 - 15:05 👤 Editor: Jakub Motyka

- Slippage tolerance is a factor that determines whether or not you will be able to carry out an operation when buying cryptocurrency tokens (generally altcoins).

- It is the percentage of variation in the price of the token that you are willing to assume at the time of performing the operation.

- We explain in depth how it works and how you should configure it.

If you are an active user in PancakeSwap, Uniswap or SushiSwap, you will know very well what Slippage tolerance is all about, but if you are new to the platform we are going to tell you what it is about and what are the keys to operating with these limits. It is important to know it well because it directly affects the price you pay to buy or sell tokens.

What Is Slippage Tolerance?

The Slippage tolerance is the adjustment of the price "movement" limit by the amount of digital assets you are willing to accept, and is represented in the form of a percentage of the total exchange value. In other words, it is the difference in the price of the token that we are willing to tolerate that occurs while we carry out the operation: if the token rises or falls more than that price, the operation will not be carried out.

If we set a certain percentage amount on PancakeSwap, Uniswap, SushiSwap or any other exchange, it means that that will be the tolerance maximum that we are willing to accept to carry out the movement of the tokens. A movement that, in turn, depends on a multitude of factors: the liquidity of the token, the movement of the market and the volume of the operation, among others.

Now That You Know What Is Slippage Tolerance: What Is The Amount You Should Use?

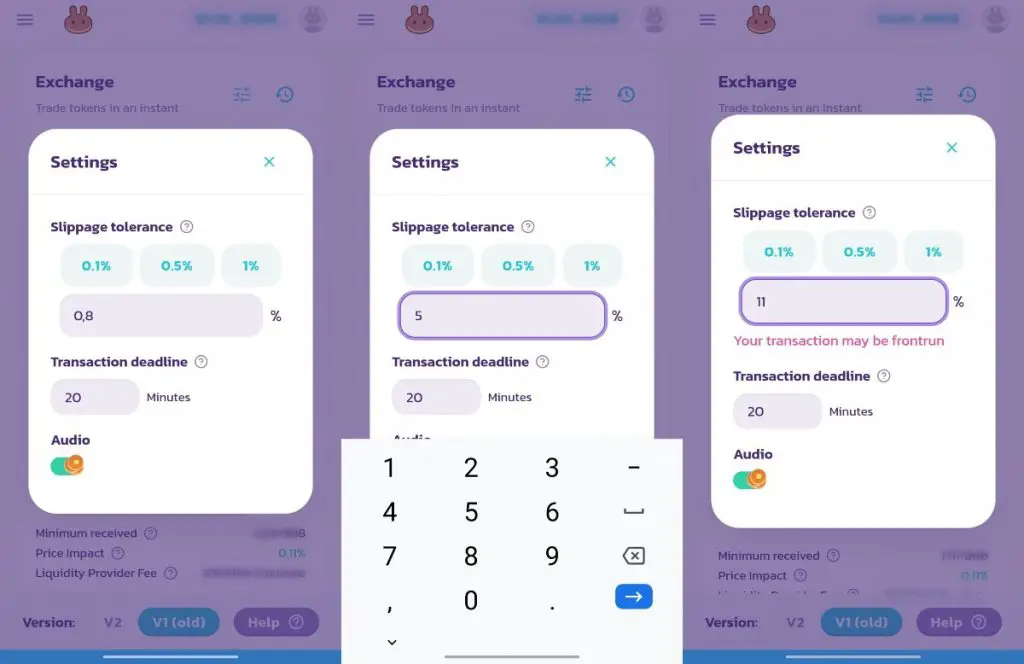

The truth is that, broadly speaking, the best way to set the Slippage tolerance percentage is to start at the lowest (0.1 or 0.5%, for example) and then gradually increase until get the operation done. Depending on the token, the percentage may be 0.5, 1, 5 or even more than 10%, which you will not discover until you manage to carry out the operation with one of these percentages.

This Slippage percentage setting command can be activated by clicking on the gear icon, which in the case of the PancakeSwap app, for example, is represented by three parallel lines, one below the other. By clicking on it you can choose between the pre-established percentages (they are the minimum percentages), as well as you can also enter a manual percentage through the keyboard.

What Percentage Of Slippage Tolerance Is Good

Usually experts on the subject assure that a low percentage in the Slippage tolerance (between 0.5 and 7%) runs lower risks than when setting other higher values, which usually vary between 8% and 16%. It is important to clarify that according to the type of operation you want to open, it is the variation of the percentage, which makes the platform automatically accept it or not, since it will depend on how many assets you have available to be able to carry out the Swap.

If an error message appears on the screen, it is possible that you should update the website or try again later, another cause may be that you are trying to negotiate an amount less than that allowed, therefore the should be increased slip tolerance variation percentage in the settings part and try again. This increase should be subtle since it can bring us considerable losses at the time of the transaction. A good solution so that it does not reject the operation that we are willing to do is to try to enter as few decimal places as possible.

We must always control the data that we write since the operation may be rejected due to low liquidity or because the percentage of Slippage Tolerance is too low to be able to carry out an exchange, which indicates that the selected ones are not enough to carry out the Swap in the Liquidity Pool since it may be that a minority is exchanging that same token because it is of a very small capitalization.

Another possibility is that you are trying to redeem a digital asset that may be a scam, which leads to not being able to sell it properly, what happens in this case is that the platform cannot block it or return the funds because it is something symbolic and non-existent in the universe of decentralized applications.

❓ Slippage Tolerance: Frequently Asked Questions (FAQs)

Let's now see some of the frequent questions that you may have about Slippage tolerance, along with the answers to the most common questions on this subject.

What Is Slippage Tolerance?

The Slippage tolerance is the adjustment of the price "movement" limit by the amount of digital assets you are willing to accept, and is represented in the form of a percentage of the total value of the trade.

What Is Slippage Tolerance Used For?

The function of the Slippage tolerance is to protect you from a sudden change in the price of the token that you are about to buy, sell or exchange (swap).

Can I Change The Slippage Tolerance Percentage?

You are free to choose the percentage of Slippage tolerance you want. Decentralized exchanges such as PancakeSwap, Uniswap or SushiSwap allow you to adjust the slippage percentage to your liking.

What Is The Risk Of Increasing The Tolerance Percentage?

If you set a slippage percentage, or Slippage tolerance, too high, and the token suffers a sudden downward price change, you run the risk that the operation is executed without you being able to do anything to prevent it.

In What Cases Can I Set A Higher Slippage Percentage?

If you are going to acquire a token that is currently in full rise in its price, you will have no choice but to raise the Slippage tolerance to be able to get hold of it while its value increases in the seconds that you prepare the transaction.

Changelog:

- 12/22/2023: Added a new tag for PancakeSwap & Uniswap, including also the link from the article to those new tags.

- Bitcoin's Bull Market To Be Confirmed In Less Than A Week - 27 de March de 2023

- Coinbase calls on developers to build inflation-linked stablecoins - 27 de March de 2023

- Save 10% Buying Your Ledger Crypto Wallet During This Black Friday - 25 de November de 2022