When Will The Next Crypto Bull Run Happen With Bitcoin (BTC)?

✍️ 14 October, 2022 - 10:43 👤 Editor: Jakub Motyka

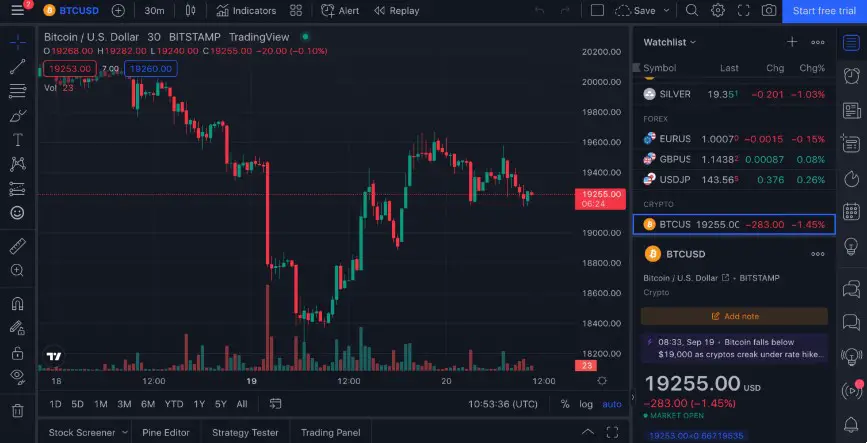

- Analysts opine that BTC is nearing a bull run as the price hovers around $18k.

- The token is trading below $20k amid a waning momentum. When will the next crypto bull run happen?

- The latest news about cryptos, in our Telegram channel.

Bitcoin (BTC) is close to a new bull run, according to analyst Arnout ter Schure. Schure maintains that as per the Elliott Wave Principle, the largest cryptocurrency by market cap bottomed on September 7 at $18,559. Consequently, Bitcoin could be due for a major surge.

Elliott Wave Principle is a technical analysis that looks at the recurrent long-term price movements. The principle is linked to the persistent changes in investor sentiment and psychology. From the metric, BTC finished a leading diagonal in August and has been correcting since then. Schure says that the correction target was 20,000 with a 5% margin.

BTC Remains Below $20k

Bitcoin fell to a three-month low of $18,390 on Monday, according to CoinMarketCap. The token was exchanging for $19,335 at the time of writing after a 4% recovery in the past day. BTC is trading below the psychological support of $20,000, with a cumulative 13% loss in the past week.

Its price has remained range-bound between $17k and $24k for the past three months. During the period, the digital asset has been trading below the 200-day moving average. Overall, the token is down 71% since peaking slightly above $68k in November last year. Part of the bearish momentum in bitcoin can be linked to the mining difficulty.

Bitcoin Mining Difficulty Hits ATH

BTC mining difficulty peaked at 32.045 hash power on Monday, as per Blockchiain.com. Mining difficulty measures how complex it is to find the right hash for a block or, simply, to mine BTC. A high difficulty means less profitability for miners and a lower Bitcoin price.

Despite the rosy projections by Schure, macro aspects are weighing down on BTC. The trend follows a high consumer price index report released on September 12. The report, which revealed a high inflation rate, has sent jitters among investors over a looming rate hike by the Federal Reserve.

Bitcoin Faces Unfavorable Macro-Economic Factors

The interpretation of the CPI data is that a high inflation rate could affect stock prices. Consequently, a spillover to cryptos will then be inevitable. Risk-averse investors remain cautious away from volatile assets. Another factor behind the extended bearish BTC momentum, according to Schure, is on the regulatory front. Investors believe that the policy standards around bitcoin are still unclear.

On the brighter side, positive bitcoin fundamentals emerge from the recent Ethereum merge. The shift by Ethereum away from the proof-of-work consensus has solidified bitcoin dominance among Pow networks.

Currently, Bitcoin commands up to 94% PoW market dominance, according to Coin Metrics. Other competing networks include Dogecoin, Ethereum Classic, Litecoin, and Monero. The development has a positive sentiment, but its impact can only be felt in the long run.

More crypto news:

- MEXC Ends The Terra Luna Classic (LUNC) Burn

- Crypto Market Recovery Won't Come Until November, Say Predictions

- The Price Of Ripple (XRP) Will Depend On The Outcome Of The Trial With The SEC

- What Is Crypto Copy Trading - 28 de March de 2023

- What Does Bitcoin FUD Mean - 28 de March de 2023

- What Is Bull Flag In Crypto And How To Identify It - 28 de March de 2023

Leave a Reply